Understanding how to calculate the predetermined overhead rate is essential for businesses aiming to accurately allocate their manufacturing overhead costs. This rate is critical for cost accounting as it helps in predicting the overall expenses related to the production process. By determining this rate, businesses can enhance their pricing strategies and financial planning. The price a business charges its customers is usually negotiated or decided based on the cost of manufacturing. This means that once a business understands the overhead costs per labor hour or product, it can then set accurate pricing that allows it to make a profit. Hence, one of the major advantages of predetermined overhead rate formula is that it is useful in price setting.

Calculating Overhead Rates: Formulas and Examples

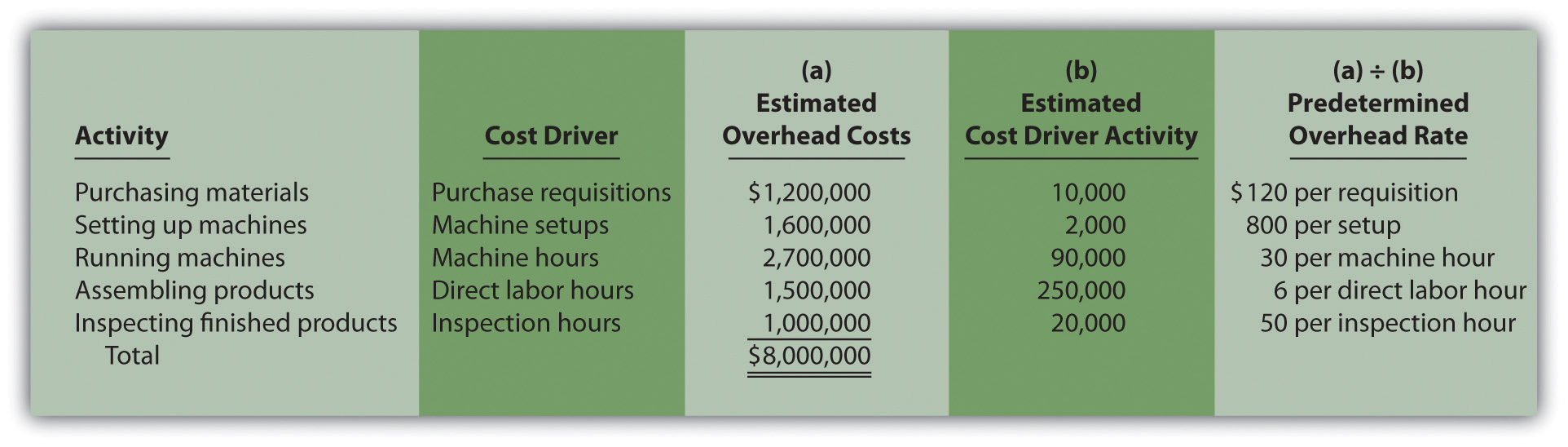

The formula seems simple – total overhead costs divided by an allocation base like direct labor hours. However, accurately calculating overhead rates involves breaking down costs and choosing the right allocation base. The predetermined overhead rate allocates estimated total overhead for an accounting period across expected activity or production volume. It is calculated before the period begins and is used to assign overhead costs to production using an allocation rate per unit of activity, such as direct labor hours.

Enhance Your Calculation with Sourcetable

The first step is to estimate total overheads to be incurred by the business. This can be best estimated by obtaining a break-up of the last year’s actual cost and incorporating seasonal effects of the current period. Further, inflationary and demand-related factors also need to be assessed.

Expense Review and Management

- Two companies, ABC company, and XYZ company are competing to get a massive order that will make them much recognized in the market.

- Once costs are broken down, small businesses can assess if any categories are excessive.

- For instance, if the activity base is machine hours, you calculate predetermined overhead rate by dividing the overhead costs by the estimated number of machine hours.

Carefully minimizing overhead is crucial for small businesses to maintain profitability. Following expense optimization best practices and leveraging technology keeps overhead costs in check. By factoring in overhead costs in this manner, the company arrives at a more accurate COGS. Allocating overhead this way provides better visibility into how much overhead each department truly consumes. Calculating overhead rates accurately is critical, yet often confusing, for businesses. However, if there is a difference in the total overheads absorbed in the cost card, the difference is accounted for in the financial statement.

Estimating Overhead Costs

Features like automated categorization and reporting provide real-time visibility into overhead costs. This calculates the percentage of indirect costs relative to direct costs. It’s a completely estimated amount that changes with the change in the level of activity. Company X and Company Y are competing to acquire a massive order as that will make them much recognized in the market, and also, the project is lucrative for both of them.

Concerns Surrounding Predetermined Overhead Rates

We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%. It’s important to note that if the business uses the ABC system, the individual activity is absorbed on a specific basis. For instance, cleaning and maintenance expenses will be absorbed on the basis of the square feet as shown in the table above. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. This can result in abnormal losses as well and unexpected expenses being incurred. There are still many points to consider before using a predetermined rate.

Discover the top 5 best practices for successful accounting talent offshoring. Learn about emerging trends and how staffing agencies can help you secure top accounting jobs of the future. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Now, let’s dive into the step-by-step method to calculate your overhead rate. It’s a simple process that requires you to gather some data and do a bit of math. Using small business accounting software centralizes overhead tracking and analysis.

Businesses monitor relative expenses by having an idea of the amount of base and expense that is being proportionate to each other. This can help to keep costs in check and to know when to cut back on spending in order to stay on budget. To why is my tax refund delayed, divide estimated overhead by the allocation base. This consolidates overhead cost information from multiple sources, including payroll, point-of-sale, billing and more.

So, the businesses need to do a cost-benefit analysis before implementing the ABC system of costing. On the other hand, if the business wants to use actual overheads, it has to wait for the end of the month and get invoices in hand. So, it may not be a good idea with perspective to effective business management. To estimate the level of activity, sales and production budget can be used. However, there is a strong need to constantly update the production level depending on the seasonal fluctuations and the factor affecting the demand of the product.

When you determine all company’s manufacturing overhead costs, add them to get the total. The predetermined overhead rate, also known as the plant-wide overhead rate, is used to estimate future manufacturing costs. A predetermined overhead rate is an allocation rate given for indirect manufacturing costs that are involved in the production of a product (or several products). For this, you can take the average manufacturing overhead cost for the previous three months, and divide this by the machine hours in the current month. If you then find out later that in fact the actual amount that should have been assigned is $36,000 dollars, then the $4000 dollar difference should be charged to the cost of goods sold.