Blogs

Other online casino games and you can lotteries will be taxed in another way. Should you choose winnings over the generating endurance if you are taxed, 24% of your profits will be withheld. The new Indiana Department away from Revenue requires you to definitely declaration all your lotto winnings on the internet 21 on the year shown to your Setting 1040. The new local casino agent is publish a great W-2G demonstrating the newest betting income tax he’s withheld and your taxable winnings. Gaming and taxation to have non-owners take payouts they rating from Indiana’s horse racing songs and you may riverboats.

- Courses are a money to own gamblers who’re not used to per ways playing otherwise want to find out more about the different sort of bets and methods offered.

- Which are the legislation and you can regulations in accordance with on line playing in your region?

- Determine exactly how much away from a cut out a sportsbook is using up a playing market according to the possibility.

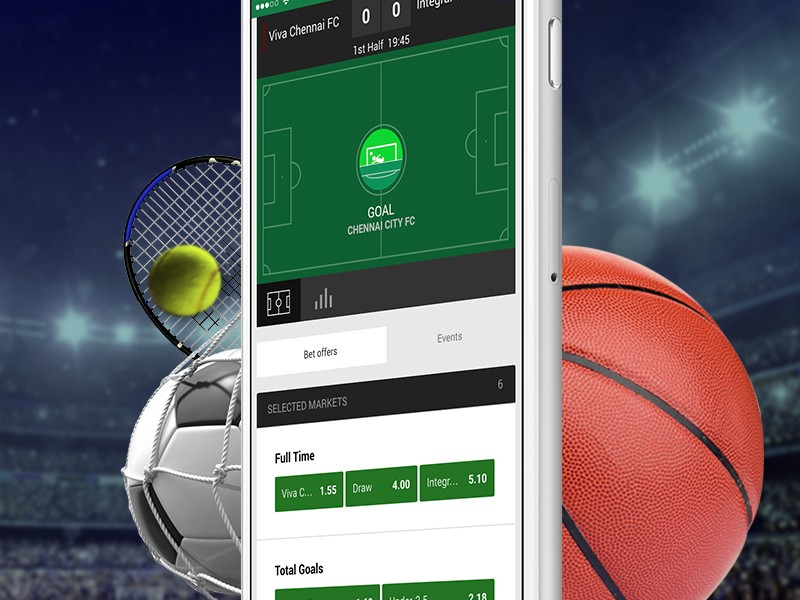

From the focusing on how the new calculator performs and you may following the resources intricate within this publication, you could potentially create a winning strategy that works for you. Examine some other bets – Use the patent choice calculator or other calculators examine other type of wagers and discover which one contains the greatest potential payment. You can use our choice calculator to have patents to possess a wide list of activities, as well as pony race, sporting events, basketball, baseball, and much more.

Ladbrokes acca insurance: Why Have fun with Our Bet Calculator?

Since this is a simple bet no special conditions, you don’t see people choices ladbrokes acca insurance . Charlie also can allege a credit to the taxes withheld by the the new track for the Function 1040. This will lose his income tax accountability because of the number of the fresh withholding.

User Opportunity

Failing to report betting profits within the Iowa have individuals effects. The newest Iowa Agency away from Cash positively checks and you will enforces conformity having regulations to your all of the income taxes. Unless you report their playing winnings, you can also face punishment, penalties and fees or court consequences. Audits and you will analysis might be used to see unreported money, causing additional fees owed, interest charge and possible criminal costs for tax evasion.

$600 or maybe more of one pari-mutuel enjoy (horse rushing, an such like.), offered the brand new payout is at minimum three hundred times the new wager amount. The new marginal taxation rates ‘s the bracket your earnings drops to your. The newest effective tax rate is the payment you have to pay after fundamental deductions, etc., and you may works on the a sliding scale according to submitting condition and you may complete taxable earnings.

Bet365

Get into fee chance for a good placeNaturally, you wear’t have the complete possibility should your horse simply manages to place. Plain old percentage are ⅕ odds, but also for a rush with only a number of runners, it’s sometimes ¼ opportunity. Toggle “Signal 4” on/offThis element can help you cause for what’ll happens if the a pony doesn’t run-in the fresh competition.

Favor your own trifecta wager kind of from regular, talked about, boxed, and you may roving banker. A roving banker trifecta choice comes to looking for one or more ponies to get rid of within the a particular position , and then going for other ponies to get rid of on the remaining ranks. The fresh ponies chose on the leftover positions will likely be any number along with people buy. In this case, you believe their horse often victory, you come across “Winnings.” Identify the place words according to the bookmaker’s offer, that’s 1/4 to the very first dos towns. Like “Decimal” as the it’s likely that portrayed inside quantitative structure.

Enhances Comprehension of Cutting-edge Wagers

I mentioned before one learning to determine the new return on the a wager is one of the earliest standards so you can establishing the fresh best bets. When you lay an individual wager the new formula is pretty simple. Intended opportunity or playing chances are likely distinctive from the real opportunity. Gaming opportunity is actually a commission ratio with the household funds margin built into it.